US Army Takes Cue From Wall Street For Officer Bonuses

'a market‑based approach'

Last updated: 2026-02-21 19:40:33 ET

Pulse AI Brief

Updated Feb 21, 2026 6:00 PM ET

Pulse AI Brief

Updated Feb 21, 2026 6:00 PM ET

The cryptocurrency market has retraced nearly all gains made during the 2024-2025 U.S. election period following a historic crash. This downturn has erased significant investor wealth and led to heightened market anxiety.

The crash has led to a sharp decline in crypto asset prices, affecting major cryptocurrencies like Bitcoin and Ethereum, and causing ripple effects across related stocks and financial instruments.

This volatility underscores the inherent risks in the crypto market and may lead to increased regulatory scrutiny as governments aim to protect investors.

'a market‑based approach'

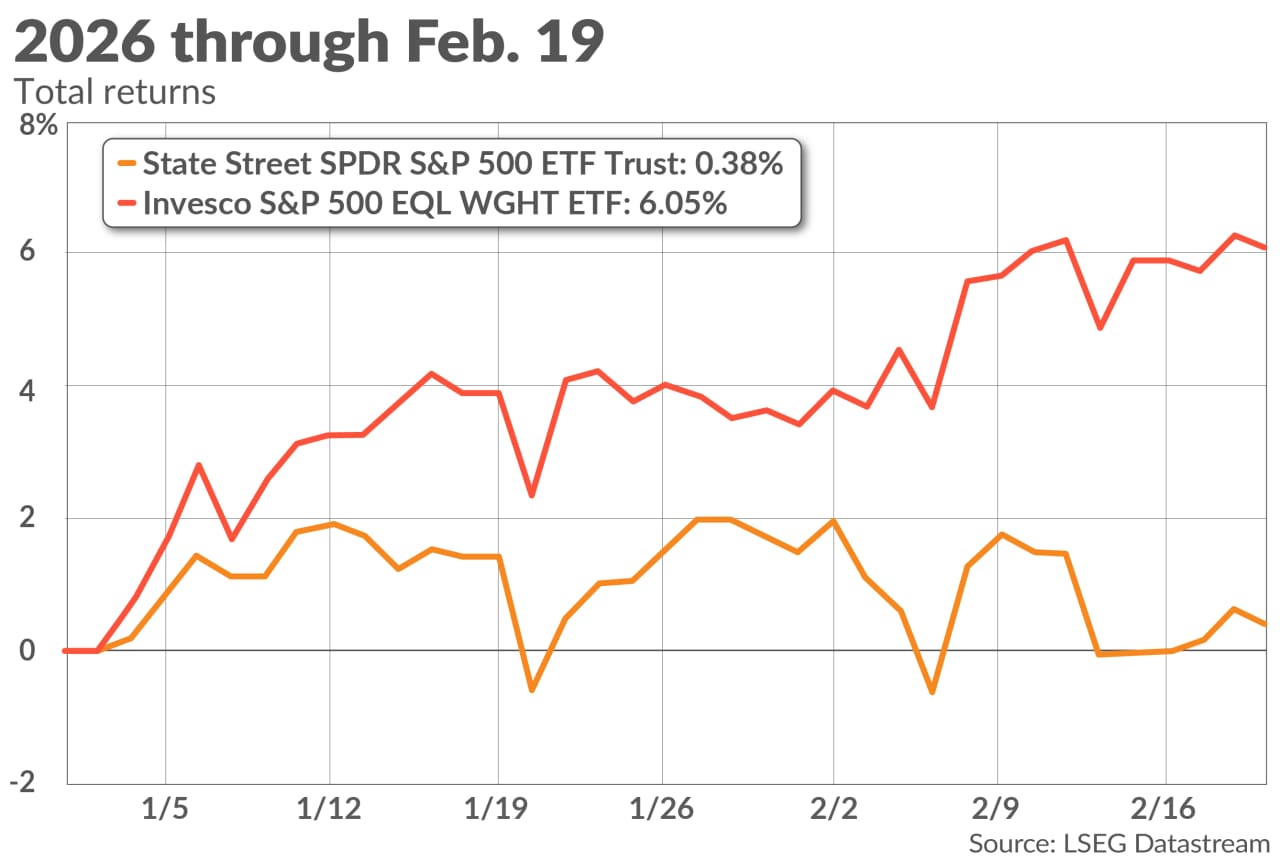

The stock market staged a comeback, even as Wall Street waded through a flurry of both upbeat and unsettling headlines.

The market volatility may be leading retail investors astray.

What's far less certain is the longer-reaching impacts as the economy and markets again adjust to a changing landscape.

The oil market's biggest fear is that a conflict between the U.S. and Iran could lead to a prolonged disruption of oil flows through the Strait of Hormuz.

The storied Los Angeles retailer, once recognized as an arbiter of West Coast style, has been acquired by the mass-market brand Aritzia.

Also in Weekend Reads: Reactions to the Supreme Court ruling against Trump’s tariffs, AI and your taxes, and a deeper look into business-development...

Despite the sharp multi-month market downtrend, Bitcoin whales added 236,000 BTC since December 2025, with order size data showing large players build...

Earnings reports will flood the market next week. Could this be the juice the S&P 500 needs?

The proposed ETFs are all tied to prediction markets related to U.S. elections.