Why A 'Suspected' Yen Intervention Just Sent The Dollar Sliding

Pessimistic

-24.6

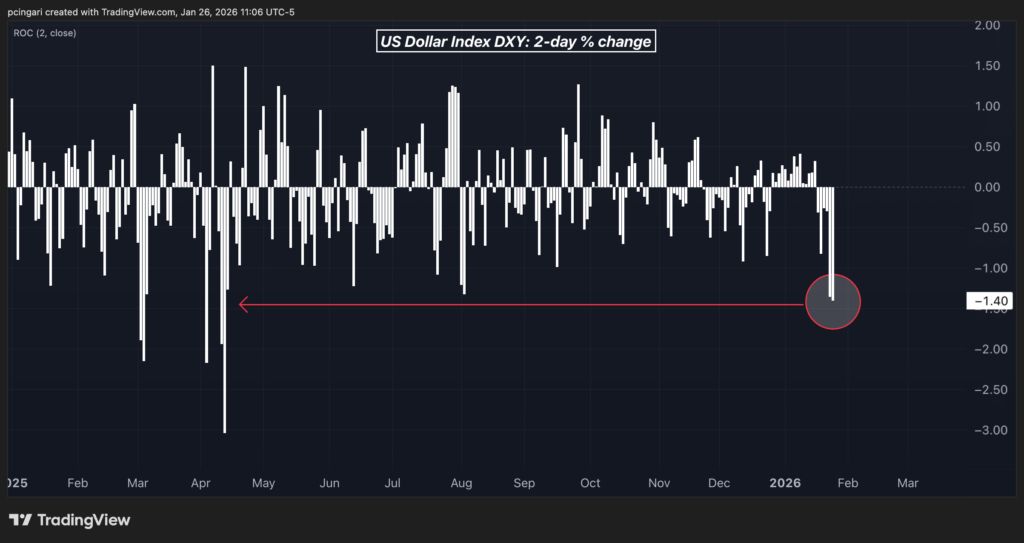

The U.S. dollar is once again under pressure, on track for its worst two-day decline since April 2025, as mounting speculation over currency intervention to support the Japanese yen rippled across global markets.

The U.S. dollar index (DXY) — widely tracked through the Invesco DB US Dollar Index Bullish Fund (NYSE:UUP) — fell 0.6% on Monday, extending Friday's 0.9% drop.

At the center of the turbulence is the yen.

The Japanese currency, tracked by the Invesco CurrencyShares Japanese Yen Trust (NYSE:FXY), surged more than 3% over the past two trading sessions, marking one of its strongest two-day advances in years.

Suspected Intervention Triggers FX Rout

"Suspected intervention to sell USD/JPY, plus U.S. authorities reportedly getting involved, has prompted a near 3.5% drop since Friday m

The U.S. dollar index (DXY) — widely tracked through the Invesco DB US Dollar Index Bullish Fund (NYSE:UUP) — fell 0.6% on Monday, extending Friday's 0.9% drop.

At the center of the turbulence is the yen.

The Japanese currency, tracked by the Invesco CurrencyShares Japanese Yen Trust (NYSE:FXY), surged more than 3% over the past two trading sessions, marking one of its strongest two-day advances in years.

Suspected Intervention Triggers FX Rout

"Suspected intervention to sell USD/JPY, plus U.S. authorities reportedly getting involved, has prompted a near 3.5% drop since Friday m

Pulse AI Analysis

Pulse analysis not available yet. Click "Get Pulse" above.

This analysis was generated using Pulse AI, Glideslope's proprietary AI engine designed to interpret market sentiment and economic signals. Results are for informational purposes only and do not constitute financial advice.