Silver Sets New Records At $75, Eyes Best Month And Year Since 1979

Bullish

64.4

Silver futures surged to a historic $75 per ounce on December 26, capping off a breathtaking rally that has pushed the metal into uncharted territory. The move has been driven in large part by acute physical shortages in China, where a retail buying frenzy has collided with tight supply, sending prices sharply higher.

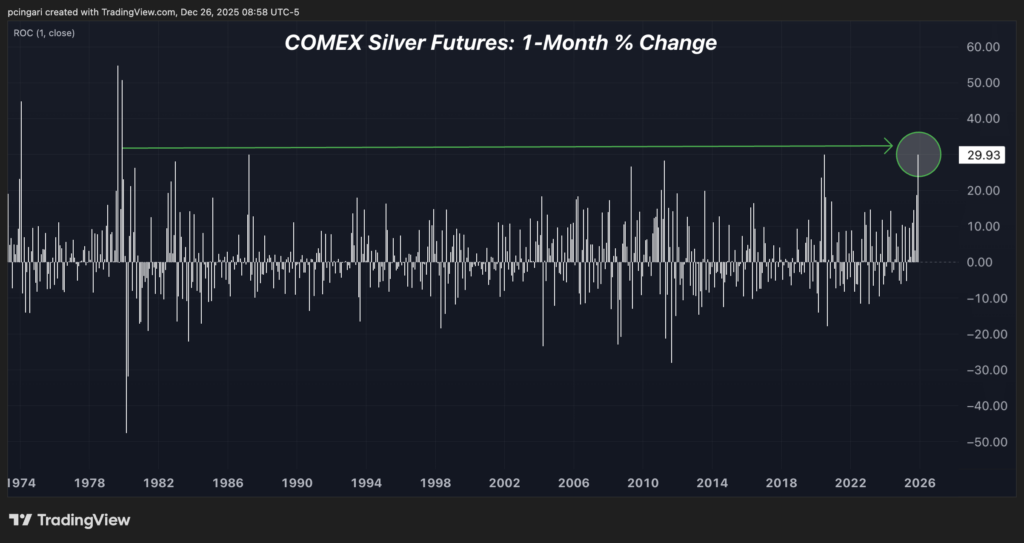

Month to date, COMEX silver – as tracked by the iShares Silver Trust (NYSE:SLV) – is up roughly 30%, putting it on pace for its best monthly performance since December 1979.

On a year-to-date basis, the metal has gained nearly 155%, also marking its strongest annual performance since the late 1970s — a period remembered for the infamous Hunt brothers' attempt to corner the silver market.

"China is facing a literal shortage of physical silver," wrote ‘The Kobeissi Letter’ o

Month to date, COMEX silver – as tracked by the iShares Silver Trust (NYSE:SLV) – is up roughly 30%, putting it on pace for its best monthly performance since December 1979.

On a year-to-date basis, the metal has gained nearly 155%, also marking its strongest annual performance since the late 1970s — a period remembered for the infamous Hunt brothers' attempt to corner the silver market.

"China is facing a literal shortage of physical silver," wrote ‘The Kobeissi Letter’ o

Pulse AI Analysis

Pulse analysis not available yet. Click "Get Pulse" above.

This analysis was generated using Pulse AI, Glideslope's proprietary AI engine designed to interpret market sentiment and economic signals. Results are for informational purposes only and do not constitute financial advice.